Offer payment flexibility and convenience to your customers

Increase customer satisfaction and loyalty. Able to keep your customers happy and coming back for more, to make purchases.

Increase your conversion rate and reduce abandon carts

Easy for customers to make purchases and increase in sales on your platform. For example, a sneakers priced at RM300. A customer immediately complete the purchase because RM100/month seems more affordable, with a pay-later option .

Expand your customer base to reach a new group audience

Can attract new customers who are interested in this payment option and help to differentiate your business from competitors who do not offer this option, giving you a competitive edge.

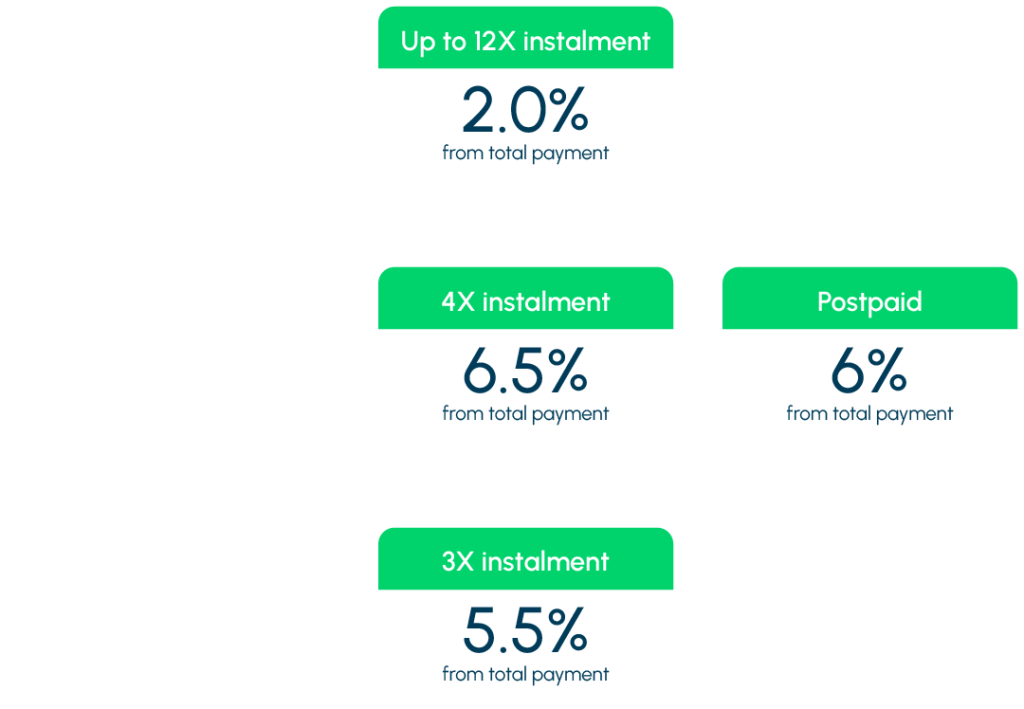

Competitive transaction rate that opens up a new possibilities

Free your mind without having to worry about no-paying instalment customers with our BNPL options. Sell, get paid and let the providers handle the rest.